A local optometrist’s office in Miami once received a call from a patient who was confused about her coverage details while discussing her recent eye exam. The patient’s experience highlights the importance of understanding the intricacies of vision insurance in Florida. Coverage details, cost management, and understanding policy specifics are essential to ensuring a smooth experience when accessing the vision care you need. In an environment where both health and vision care plans are evolving, consumers are increasingly seeking transparency and reliability. Notably, recent efforts in other insurance areas in Florida indicate that reforms and industry stabilization efforts are influencing consumer confidence in insurance products, including vision care. For example, a study by The Vision Council noted a 13 percentage point gain in satisfaction for individual managed vision care plans between 2023 and 2024 (The Vision Council).

This comprehensive guide will explore the essentials of Florida vision insurance-from plan options and benefits to potential challenges and opportunities. As the insurance market adjusts to changes driven by legislative reforms and market pressures, understanding your vision insurance coverage is more crucial than ever.

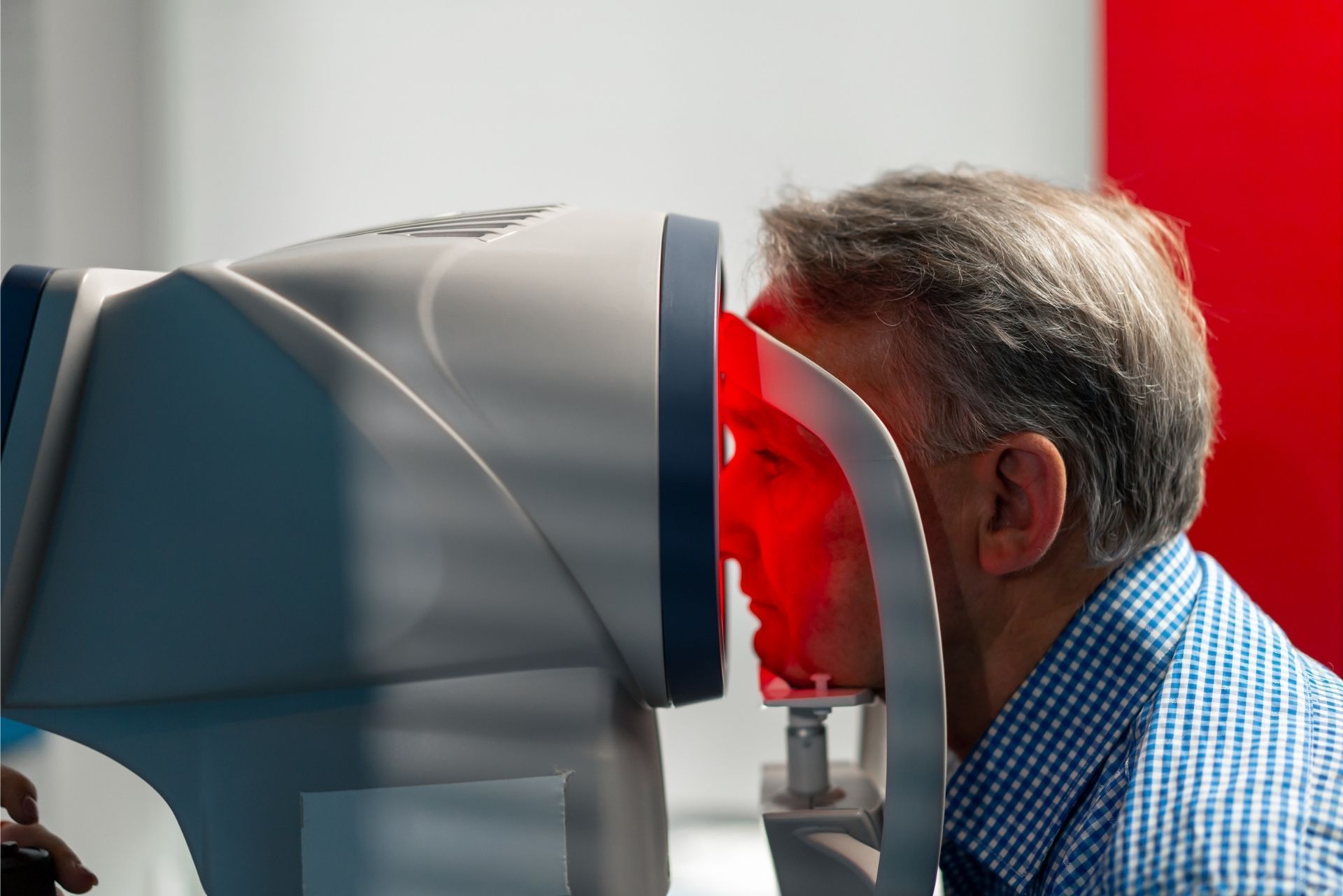

Vision insurance provides a range of benefits that extend well beyond the basic eye exam. Many plans include coverage for routine eye examinations, corrective lenses, and sometimes discounts on elective procedures like LASIK. In evaluating your choice of vision insurance, consider not only the cost but also the network of providers and additional services that may be offered.

Multiple plan options exist in Florida that cater to diverse needs. Many employers provide group vision coverage, which is often more cost-effective, while individual plans are available through private insurers and certain state-supported exchanges. Independent surveys suggest that consumers are generally satisfied with managed vision care plans-a trend that saw significant improvement from 2023 to 2024 (The Vision Council).

Choosing the right plan involves comparing deductibles, co-insurance, and the details of in-network versus out-of-network benefits. Many plans may offer convenient add-on benefits, such as discounts on eyewear or even prescription savings. With Florida’s diverse population and varying vision care demands, having a tailored plan can greatly simplify cost management and improve access to quality eye care services.

Understanding Key Benefits and Coverage Details

Vision insurance is structured to help mitigate the costs associated with eye care-both preventive and corrective. Major benefits typically include annual eye exams, a portion of the cost of prescription glasses or contacts, and occasionally coverage for advanced treatments. Consumers now look for clarity in benefit explanations so that surprises at the time of claim do not hinder accessing the necessary services.

Some policies also provide extended benefits such as coverage for a broader range of prescription lenses and discounts on elective procedures. Precision in benefit detail is especially important in Florida, where a mix of private and employer-based plans compete to meet the needs of a dynamic consumer base. Understanding these benefits is also helpful when considering how vision insurance relates to overall health insurance strategies.

For example, a survey by Florida Blue revealed that nearly half of Florida residents felt the health insurance shopping process could be simpler

(Florida Blue). Clarity in vision insurance benefits supports the broader initiative to streamline insurance processes, making it easier for Florida residents to grasp what they are paying for and how they can maximize their coverage.

The Impact of Legislative Reforms on Insurance Products

Florida's insurance market has experienced significant changes in recent years, particularly in property or home insurance. Legislative reforms aimed at stabilizing the market have shown promising results, with some lines of business reporting profitable underwriting after a period of financial distress. These shifts have a ripple effect on other insurance products, including vision insurance. Improved regulatory clarity and market stabilization can create an environment that encourages competition and innovation across all insurance sectors. For example, recent property insurance reforms have brought hard-won underwriter profits back to near profitability (Insurance Information Institute).

The confidence instilled by these legislative changes can lead to better consumer offerings and investments in customer service across the board. As insurers adapt to new cost containment measures and legal reforms, their enhanced stability often allows for improved coverage terms and more responsive customer services in related products like vision insurance. This improved outlook can ultimately create more competitive and reliable policies for consumers.

Legislative reforms and a more secure market environment also benefit insurers by reducing unpredictable litigation expenses and lowering overhead costs. While these changes appear prominently in the property insurance market, the effects are not isolated. The resulting clarity and reduced risk of litigation can extend benefits to vision insurers as well, providing a more balanced marketplace where well-structured plans thrive.

How Vision Insurance Works in Florida

Vision insurance works differently from comprehensive health coverage, placing a strong emphasis on routine eye care. Most plans offer scheduled preventive visits, which can help with early detection of conditions that might otherwise progress unnoticed. This preventive model is critical because symptoms associated with eye conditions can sometimes be subtle, leading to more complicated treatments if left unchecked.

Under most vision policies, a member pays a relatively low premium for routine benefits while covering a fixed percentage of costs for additional services. This risk-sharing characteristic allows consumers to access high-quality eye care without the burden of excessive out-of-pocket expenses for preventive services. However, it is essential to review each policy’s fine print carefully, as coverage specifics can vary significantly between insurers.

Routine eye exams, for instance, may be covered completely or require a small copay, while corrective lenses usually involve a deductible or co-insurance. Florida residents should carefully evaluate in-network provider directories because costs incurred out-of-network can quickly increase and diminish the perceived value of the plan.

Core Components of Vision Insurance Plans

Typically, a vision insurance plan is built on these core components:

- Annual eye examinations

- Coverage for prescription lenses or contacts

- Allowance for frames and lenses

- Discounts on elective procedures or advanced eye care treatments

Plans may also include extras such as discounts for laser vision correction and other elective services. These extras often serve as an incentive for consumers who want more than just basic coverage. For those who frequently require updated eyewear, a plan that makes such adjustments cost-effective can be a smart investment in overall health management.

Examples of Coverage and Cost Sharing

To illustrate, consider a plan where the annual exam is fully covered and corrective lenses come with a modest copay. With such a plan, a customer could avoid unexpected bills and receive a consistent, quality service cycle. Conversely, plans with higher deductibles might offer lower premiums but lead to greater expense when significant eye care is needed.

Many insurers structure their coverage to include a mix of both preventive care and cost-sharing for corrective procedures. Understanding these details is essential for clarity and effectiveness in managing both regular and unexpected eye care expenses.

Consumers should also be aware that some insurers now offer enhanced digital tools to manage appointments, process claims, and access information in real time. This technological push provides a layer of convenience and transparency that reassures policyholders, especially in a state where customer expectations are high.

Comparing Vision Insurance Plans in Florida

When it comes to comparing vision insurance plans, it is beneficial to look at the differences in cost-sharing, provider networks, and additional benefits. A side-by-side comparison can highlight the subtle differences that ultimately drive value for the consumer. For many residents, the difference between similar plans comes down to factors such as the size of the provider network and whether a plan offers discounts on services beyond routine examinations.

The table below summarizes key distinctions between a basic vision insurance plan and an extended vision insurance plan available in Florida.

| Feature | Basic Vision Plan | Extended Vision Plan |

|---|---|---|

| Annual Eye Exam | Covered fully or with a small copay | Covered fully with extra benefits like advanced screening |

| Prescription Lenses | Standard allowance with moderate co-insurance | Higher allowance and reduced co-insurance |

| Frames and Lenses | Limited allowance per year | Enhanced allowances and discounts on designer frames |

| Elective Procedures | Discounts available on select procedures | Expanded discounts on elective procedures and treatments |

| Network Size | Moderate network access | Larger network with extensive provider partnerships |

This comparison helps clarify the differences in value. It also encourages consumers to identify which features are most important based on their personal vision care needs. In Florida, where provider availability can vary widely by region, such a table serves as a useful guide when comparing and contrasting plans.

While reviewing options, ensure that the selected plan aligns with both your current vision care needs and anticipated future requirements. A careful cost-benefit analysis can help in choosing a plan that offers the right balance between immediate care and long-term security.

Trends and Consumer Perspectives on Vision Insurance

Recent surveys have shown that satisfaction levels with managed vision care plans have risen, highlighting increased consumer confidence in these offerings (The Vision Council). This improvement in satisfaction is attributed to better transparency, more comprehensive benefits, and an overall shift towards consumer-friendly plan designs. Rising competition among insurers in Florida has also contributed to more accessible and competitive pricing structures.

A growing number of Florida residents are now evaluating insurance products based on the clarity of coverage details. With many choosing plans that offer full coverage for annual eye exams and attractive allowances on eyewear, the emphasis today is on balancing quality services with financial predictability.

Feedback from various surveys indicates that clarity in covered benefits is a recurring theme. Nearly half of respondents in a recent study by Florida Blue expressed a need for a more straightforward understanding of covered benefits

(Florida Blue). This consumer demand has prompted many insurers to streamline their policy details and invest in customer support systems designed to clarify these nuances.

Addressing Challenges and Embracing Opportunities

Despite many positive trends, challenges continue to exist within the vision insurance landscape. One key issue is the overall complexity of policy language, which can leave consumers uncertain about what expenses are covered. Educating policyholders, providing clear examples, and supporting customer service efforts are effective ways to address this challenge.

Technological advances such as online appointment scheduling, electronic claims processing, and mobile account management are now standard offerings that help to minimize confusion. Insurers who invest in these conveniences not only enhance customer satisfaction but also build trust and loyalty over time. In a climate where consumer expectations are high, these initiatives help bridge the gap between cost management and quality care.

Another challenge is ensuring that providers remain accessible, especially in regions where the provider network might be limited. Consumers in rural Florida, for example, may face longer wait times or a smaller pool of providers compared to those in metropolitan areas. Addressing these issues requires ongoing efforts from insurers to expand network relationships and adopt innovative solutions, such as tele-optometry consultations.

How Insurers are Adapting to Change

Industry experts note that lessons learned from property insurance reforms have informed broader insurance strategies in Florida. As seen in recent reports, reduced litigation costs and improved underwriting profits in other lines of business have created an environment in which insurers are better poised to invest in customer-friendly initiatives (Deep Sky Research).

For vision insurance, these improvements translate into more robust networks, clearer policy language, and investments in digital service delivery systems. With a greater emphasis on consumer support, the industry is navigating the ongoing challenges by learning from parallel market reforms.

Insurers are particularly focused on reducing the impacts of increasing cost pressures while keeping premiums competitive and benefits extensive. This balance is critical, as consumers demand both affordability and high service quality in their vision care plans.

Vision care is an indispensable component of overall health strategy. Many conditions that affect vision can also be indicative of broader health issues, like diabetes or hypertension, making regular eye exams essential for early detection. By integrating vision care into a comprehensive health strategy, consumers can more effectively manage their overall well-being.

In Florida, where health insurance and vision care trends increasingly overlap, many insurers emphasize the importance of routine screening and preventive care. This approach not only helps manage costs over time but also builds a stronger safety net for long-term health outcomes. The consumer-centric improvements seen in vision insurance are part of a broader trend across health care insurance markets, ensuring that all aspects of health, including eye care, are managed effectively.

For those searching for coordinated coverage options, it is worth examining how your vision insurance benefits might complement other health care investments, such as those offered through employer-sponsored benefits or marketplace plans. The potential for integrated care models means that your vision provider may also be able to liaise with other health professionals to provide a more unified care experience.

Cost Considerations and Maximizing Your Vision Plan

Cost is naturally a major factor when selecting any insurance plan. Vision insurance, in particular, must strike the right balance between premium affordability and adequate coverage for necessary eye care. Consumers are encouraged to analyze the total cost of care, rather than simply opting for the lowest premium available.

Some policies may offer lower premiums at the expense of higher copays, while others might include robust benefits for a somewhat higher monthly rate. Given the complex interplay of deductible amounts, copays, and the frequency of required services, a closer examination of cost breakdowns is essential.

The following table summarizes some common cost-related considerations for vision insurance plans:

| Cost Element | Consideration | Potential Impact |

|---|---|---|

| Premiums | Monthly fee for plan enrollment | Lower premiums might suggest limited coverage |

| Deductibles | Amount paid before benefits kick in | Lower deductibles ease financial burden at service time |

| Copayments | Fixed amount paid when services are rendered | Smaller copays support frequent preventive care |

| Co-insurance | Percentage of costs shared after deductible | Affects out-of-pocket costs for expensive procedures |

This side-by-side arrangement helps illustrate where cost pressures originate and how each plan element impacts overall affordability. Consumers should carefully compare these details, particularly as they relate to their vision care history and expected future needs, as an informed decision in this area can lead to considerable savings over time.

For many Floridians, maximizing the benefits from a vision insurance plan entails periodic reviews of both premium structure and covered benefits. Taking advantage of any offered digital tools, like mobile apps or online claim status tracking, can simplify the management of your overall vision care expenses.

The Role of Customer Support and Digital Innovations

Customer support may often be the subtle factor that differentiates one insurer from another. With the increasing complexity of insurance products, including vision plans, the value of effective, accessible customer service cannot be overstated. Many companies are now offering enhanced digital portals that allow users to easily manage appointments, check claim statuses, and receive real-time notifications regarding policy updates.

This rise in digital innovation is particularly beneficial in a state like Florida, where consumers expect a high standard of transparency and responsiveness. From scheduling to claims resolution, digital tools contribute significantly to reducing the friction often associated with insurance administration. The integration of these tools reflects a growing trend where insurers leverage technology to meet the expectations of modern consumers.

Some providers also offer tele-optometry consultations, a service that can be invaluable for those in more remote locations or for those with time constraints. The ability to conduct a preliminary vision screening online offers convenience and supports early detection, ensuring that issues are promptly addressed.

Frequently Asked Questions

This section addresses common questions regarding vision insurance in Florida, helping demystify the process and provide clarity on what consumers should expect.

Q: What does vision insurance typically cover?

A: Vision insurance usually covers preventive eye exams, corrective lenses, frames, and sometimes discounts on elective procedures like LASIK. Coverage specifics can vary by plan.

Q: How do I choose the right vision insurance plan for me?

A: Compare differences in premiums, deductibles, provider networks, and benefit details to find a plan that aligns with your routine eye care and potential future needs.

Q: Can vision insurance be integrated with other health insurance?

A: Yes, many consumers benefit from integrating vision coverage with overall health plans. This approach streamlines care management and ensures early detection of health conditions that may affect vision.

Q: What are the cost considerations when selecting a vision plan?

A: Key cost factors include monthly premiums, deductibles, copays, and co-insurance rates. Assess these in relation to your expected frequency of eye exams and corrective needs.

Q: Are digital tools available to manage my vision insurance?

A: Many insurers now offer digital portals and mobile apps that facilitate appointment scheduling, claim tracking, and policy management, adding convenience and transparency.

Looking Ahead: The Future of Vision Insurance in Florida

The landscape of vision insurance in Florida is evolving in response to both consumer demand and broader industry reforms. Industry experts have highlighted that a move toward customer-centric innovations, driven by digital technologies and clearer legislative guidelines, is set to reshape how vision coverage is delivered. As seen in other areas such as property and home insurance-which recently experienced significant shifts due to legislative reforms (Deep Sky Research)-these changes promise a more stable, affordable, and consumer-friendly environment.

Looking forward, insurers may further integrate advanced technology with traditional service models, providing more personalized plan options. Increased focus on customer engagement and the use of data analytics are likely to drive improvements in both service quality and operational efficiency. For consumers, this means more tailored coverage and better tools for managing both routine care and unexpected needs.

The trends emerging today underscore that understanding your policy details, and staying informed on market changes, is essential for informed decision-making. As you plan for future vision care needs, remain attentive to both legislative developments and technology offerings that promise to simplify the insurance experience.

Final Thoughts: Maximizing Your Vision Coverage in Florida

Florida residents seeking vision insurance should take a proactive approach: research plan details, compare cost-sharing options, and examine provider networks carefully. With customer satisfaction trends rising and digital tools transforming service delivery, there is a promising path forward for quality vision care coverage in the state.

Consumers are urged to keep pace with industry changes, such as those reflected in broader insurance reforms that support customer-centric practices. As seen across multiple segments of the insurance market, clearer and more consumer-focused policies result in better experiences for policyholders.

Ultimately, the key to maximizing the benefits of vision insurance lies in staying informed and choosing a plan that not only meets immediate needs but also adapts to future challenges. For many, this means selecting a policy that offers transparent benefits, comprehensive provider networks, and digital convenience.

Wrapping It Up

Understanding and selecting vision insurance in Florida requires a closer look at policies, cost structures, and the evolution of consumer needs. With the market witnessing shifts due to legislative reforms, the future of vision insurance appears more promising and tailored to individual needs. Consumers benefit when insurers provide detailed plan comparisons and enhanced digital tools that simplify the management of their coverage.

The journey toward optimal vision care coverage involves asking the right questions and using available resources to uncover detailed policy information. Whether you are new to vision insurance or looking to refine your current plan, staying informed on industry trends can reframe how you approach your eye care needs.

For a closer understanding of market shifts impacting overall insurance stability in Florida, other sectors like property insurance offer valuable insights. Recent industry reports and expert analyses continue to underscore that legislative reforms play a significant role in stabilizing the market

(Insurance Information Institute). With these reforms in place, there is an optimistic prospect not only for property but also for vision insurance and other related products.

FAQ Recap and Key Takeaways

This guide has addressed major concerns and practical inquiries about vision insurance in Florida, providing clarity on plan options, coverage details, and cost management strategies. Consumers who carefully compare the available policies can save on unnecessary costs and enjoy comprehensive eye care without compromising on quality.

In embracing the opportunities presented by digital innovation and legislative improvements, vision insurance in Florida is poised to become more responsive and flexible. Whether you are satisfied with your current coverage or considering a switch, staying informed is the first step toward securing the most beneficial plan for your needs.

Members of the community are encouraged to continuously review their vision insurance policies, question unclear terms, and seek advice from trusted experts to ensure they fully understand their benefits. Through such diligence, maximizing your vision care benefits becomes a realistic and achievable goal.

ABOUT THE AUTHOR: PAUL RAMENTOL

I am the Owner and President of Mesa Insurance Agency. I help individuals and business owners across Florida secure personal and business insurance coverage that supports their needs. My focus is on clear guidance, direct communication, and long-term support without call-center delays or confusion.

Contact Us

Personal Coverage Options

Insurance Built for Everyday Protection

Mesa Insurance Agency provides personal insurance coverage designed to support daily life. Our team reviews risks and coverage needs to help clients secure dependable protection at fair rates.

Dental & Vision Insurance

Coverage that helps manage routine dental and vision care costs.

Business Coverage Options

Insurance Built for Business Protection

Mesa Insurance Agency provides business insurance coverage that helps protect operations, employees, and property. We work with multiple carriers to offer coverage options that support daily business activities and long-term stability.

Commercial Auto Insurance

Coverage for business-owned vehicles, drivers, and accident-related liability exposure.

General Liability Insurance

Protection against third-party injury, property damage, and common business liability risks.

Professional Liability Insurance

Coverage for claims related to professional services, advice, or service errors.

Workers’ Compensation Insurance

Coverage that helps support employees with work-related injuries and medical costs.

Commercial Property Insurance

Protection for buildings, equipment, inventory, and physical business assets.

Errors & Omissions Insurance

Coverage for financial losses caused by mistakes, omissions, or service-related claims.

Industries We Serve

Serving Businesses Across Multiple Sectors

Mesa Insurance Agency works with business owners across Florida to provide insurance coverage that supports daily operations. We understand common risks faced by different industries and help clients secure reliable protection.

Construction and Trades Insurance

Coverage for job sites, vehicles, tools, and workplace risks.

Hospitality Businesses Insurance

Insurance for restaurants, bars, and service-based operations.

Retail and

Commercial Properties

Protection for storefronts, inventory, and customer-related liability.

Our Approach

Insurance Made Easy to Understand

Mesa Insurance Agency provides business insurance coverage that helps protect operations, employees, and property. We work with multiple carriers to offer coverage options that support daily business activities and long-term stability.

What makes Mesa Insurance Agency different?

We are an independent agency with access to multiple carriers. This allows us to offer flexible coverage options.

Clients work directly with licensed agents. Service continues beyond the policy start date.

Do you offer coverage for individuals and families?

Yes. We provide personal insurance for individuals and families across Florida.

Coverage includes auto, home, health, life, and flood insurance. Our team explains each option clearly.

Do you work with small and mid-sized businesses?

Yes. We work with businesses of many sizes and industries.

Our team helps identify risks and secure appropriate coverage. Ongoing service is included.

Can I make changes to my policy later?

Yes. Policies can be updated as needs change.

We assist with coverage adjustments, additions, and removals. Clients can contact us directly for help.

Is flood insurance required in Florida?

Flood insurance is not always required, but it is strongly recommended in many areas.

Standard home insurance does not cover flood damage. Our team can review your flood risk and options.

How do I contact your office?

You can contact us by phone, email, or through our website.

Our team responds promptly during business hours. Support is always available when needed.

From the Blog

Insurance Topics That Matter

Clear answers for common questions.

Client Reviews

Trusted by Clients Across Florida

Mesa Insurance Agency is proud to serve individuals and businesses throughout Florida. Clients choose us for clear communication, responsive service, and reliable insurance support. Their feedback reflects our focus on long-term relationships and consistent service.

Contact Us